“about” when we provide a % targets because these are not hard and fast numbers, they are guidelines. Friday is a prime example of why a trader needs to always remain flexible when trading.

Our Entry

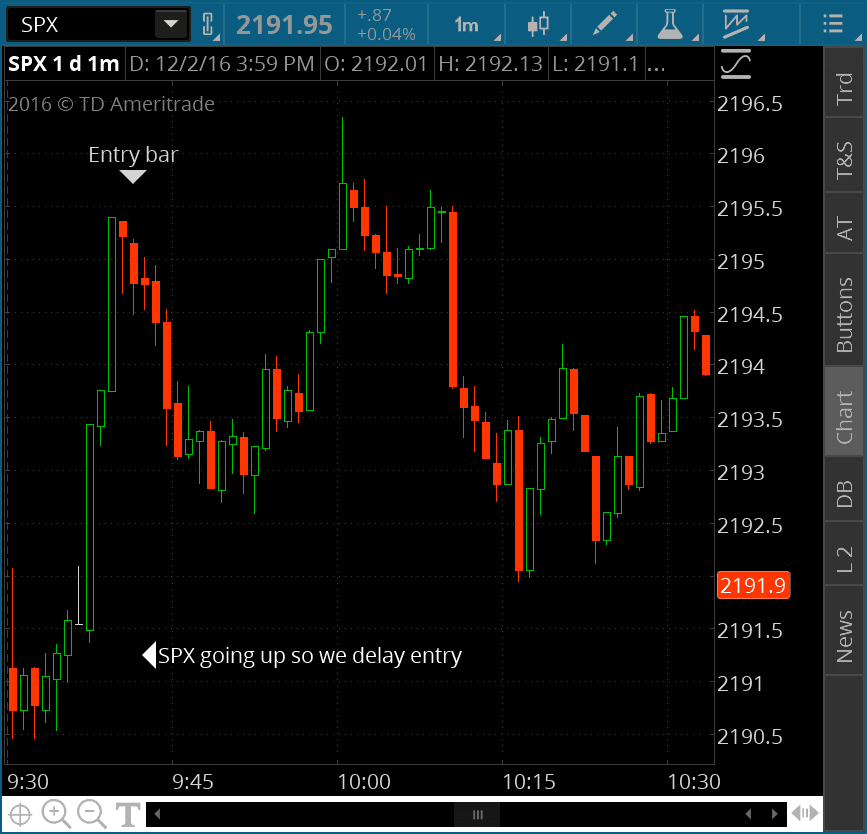

Our SPX Daily Outlook forecast a down day, and we were looking to enter a put after 9:35 am EST. However, the SPX was heading up at that time, and so we waited. We waited until 9:41 am EST to enter our position, waiting for the first indication of a turn back in the direction we were anticipating. We use 1 minute bars to help us determine entry times, when we don’t enter at 9:35, as this morning.

Managing the Trade

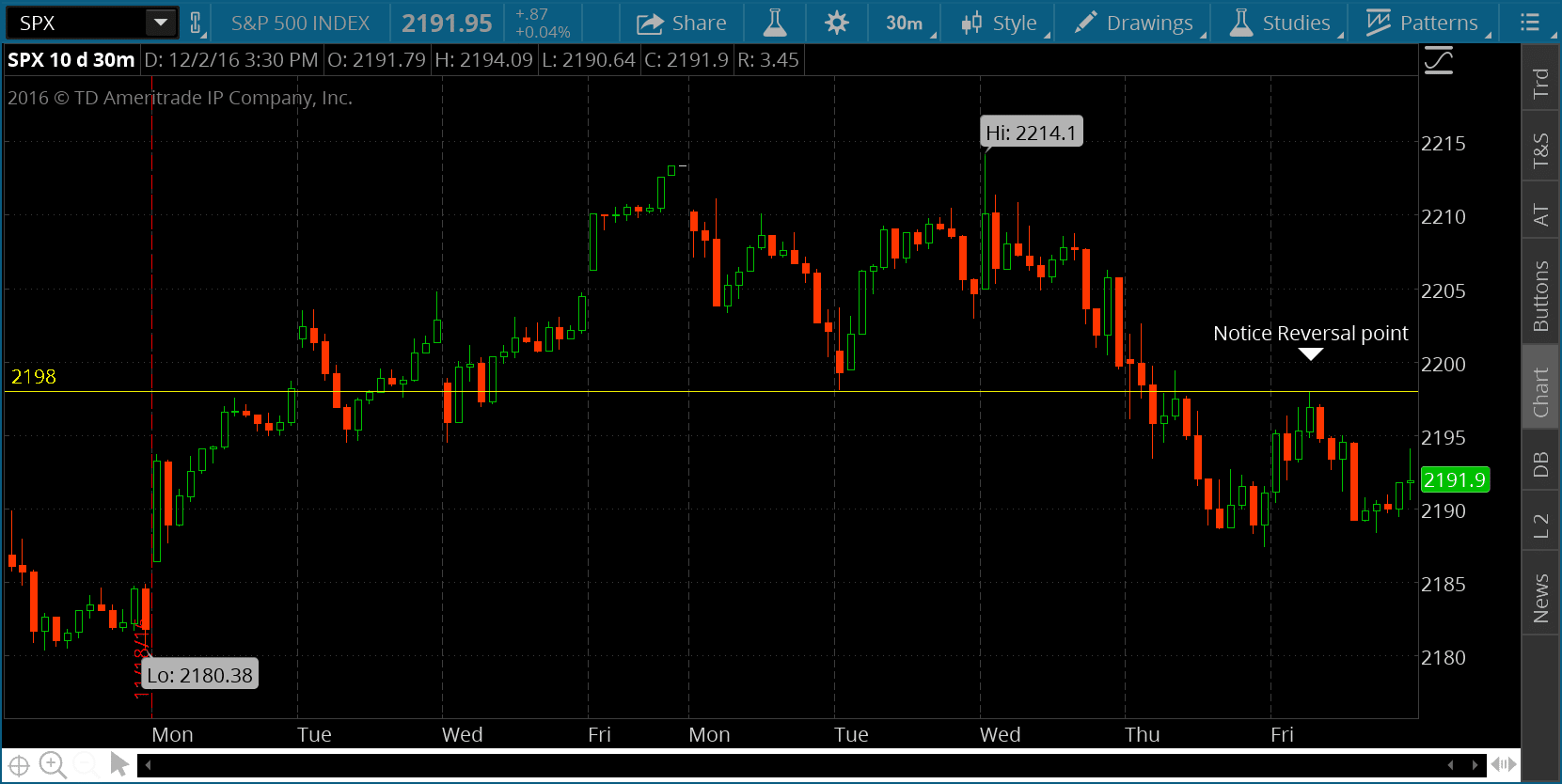

Now, let’s look at what happened at 11:00-11:30 am EST. .45 was the level we were watching for a potential stop loss, as that was -71% from our entry price. Our option traded at .35, but we didn’t exit. Because the SPX was at a level of resistance, 2198. So we were willing to give it just a little more room. That is exactly where it turned and then started our way. We were able then to ride down the rest of the day for a 39% profit.

We’ve mentioned before the importance of noting key levels on a 30 min bar chart. When looking to exit the trade, it is key to observe those levels. We don’t want to exit with a stop, if there is a good indication that the current level is at or near a support/resistance level. So we always look at those levels before exiting our trade.

This is why we recommend traders never place their stop orders ahead of time, because the market moves fast. Actually placing your stop order early, can often result in getting out at just the wrong time.

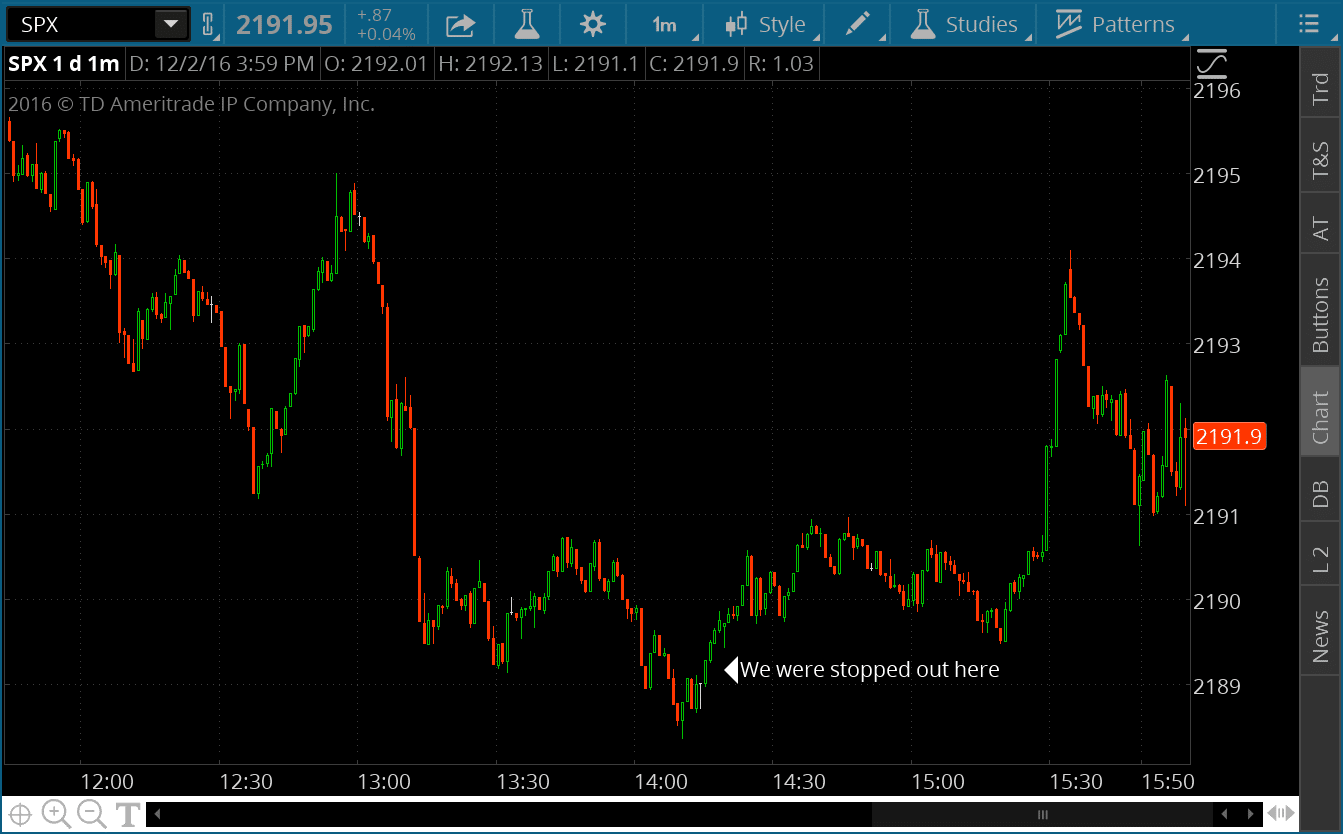

Exit

As it was running our way the Option hit 80% profit, we had a target of 120%. Initially we moved our stop to Break Even to see if we could get a further drop. But after bouncing around for a little more than an hour, at 2 pm we started following with about a 40% trailing stop. This ensured that we would take home at least some profit, and yet give it room to move if it continued the downward drop. We were taken out of the trade at 2:15 pm EST with a 39% profit.

This is how we approached our trading in the SPX on this specific day. We basically did the same approach with the SPY. Trading is never easy, and it is crucial to know when to hold ‘em and when to fold’em. Watching key levels, using support & resistance lines, noting our % targets and keeping an eye on the time of day all come into play as we seek to determine when to exit the trade.

So it was a back and forth week for us and we ended the week with a small profit. We’ll return next week as we day trade SPX & SPY weekly options.