Riding a Winner using the Target Levels

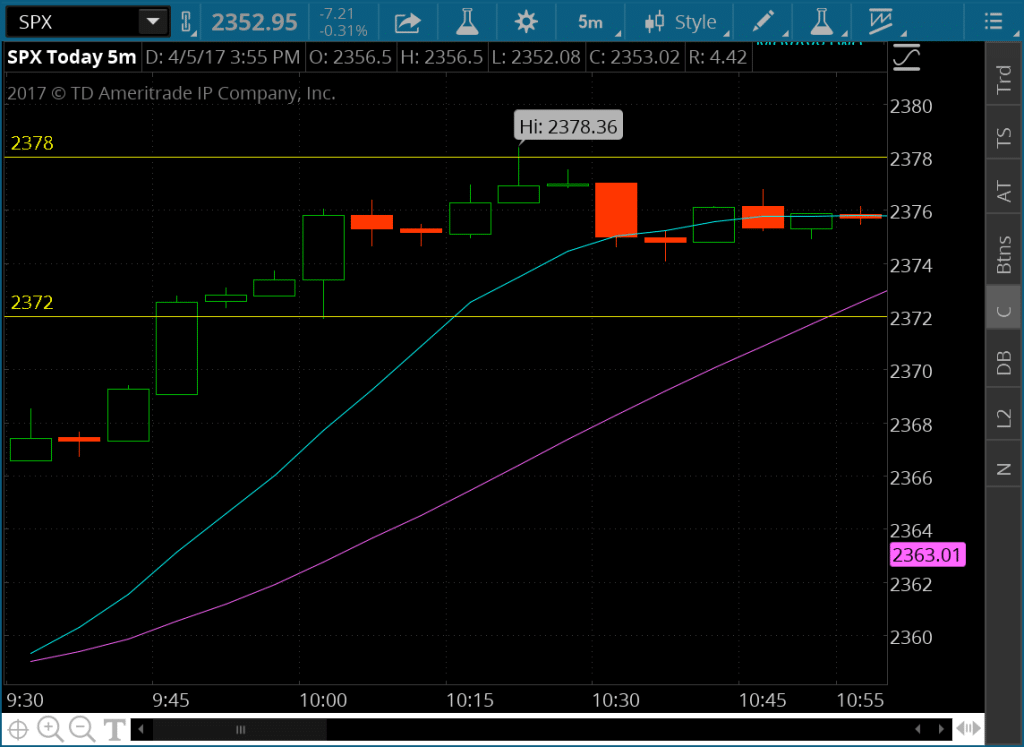

On Wednesday April 5th, we entered a 2370 call at 9:35 am at a price of 1.55 and the market responded very quickly in the right direction. On this day we had an initial profit target of 100% , and our first two Target High levels in the SPX were 2372 and 2378. Our approach is to use these levels as indicators of when to move up our trailing stops or when to exit the trade.

Once it broke 2372 so quickly. We moved our stop up to a 100% profit or about 3.10. This approach allows us to give the SPX room to continue to move, while also ensuring we will at least take home a nice profit. We were also watching the 2372 level closely. It almost took us out of the trade, with a fast pullback to this level, but because our stop hadn’t been hit in the option, we held. Then when the SPX broke our next level of 2378, our option hit a high of 539%. At that point, we moved our trailing stop up to approximately a 100% trailing stop from the high. This allows us to give our position room to move, while also ensuring that we lock in a very nice profit. The SPX stalled, and took us out for a 428% profit.

Being willing to give the option room to move is key on large days. This is why having the SPX Daily Outlook is so crucial in our trading, for it provides us with the key levels to be watching and respond to.

Knowing when to Exit using the Target Levels

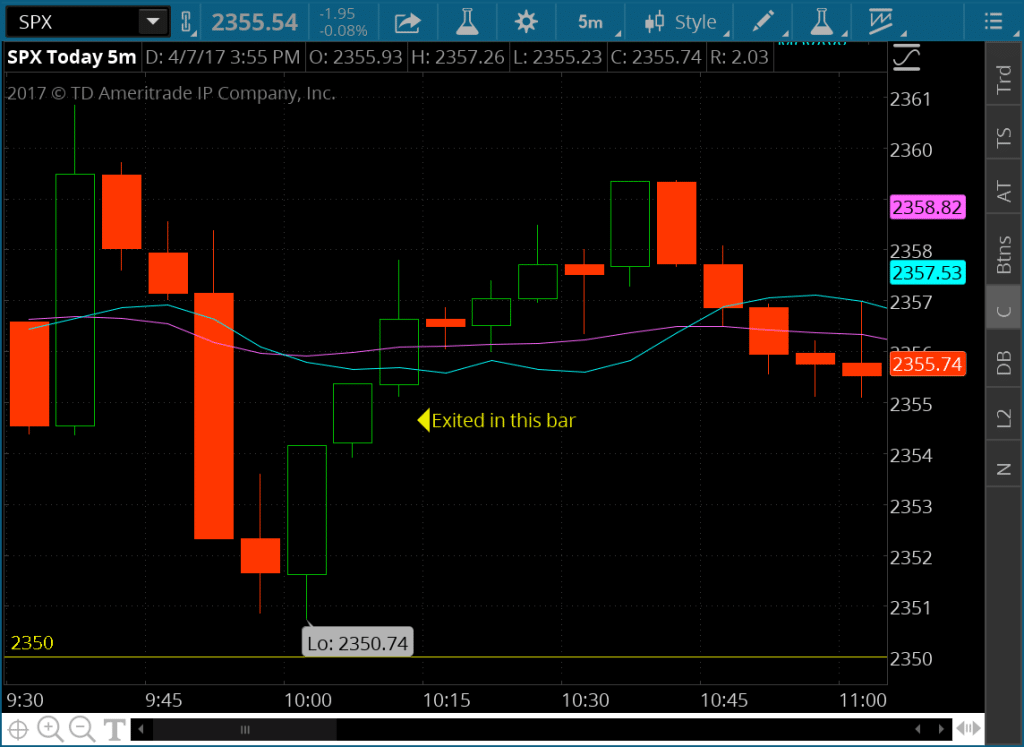

Friday, April 7th was another example of the importance of our Key levels. On this day we forecast a down day, and so we entered a put at just after 9:35 am, just as the market exploded to the upside. We entered the trade at 2.70. It rallied quickly, and then dropped just as quickly to fall down to a low of 2350.74

Our first key level was 2350. As it hit the level of 2350.74, our option was up 74%. We moved our stop up to break even at this point, because it was nearing a key level. When it started to bounce so quickly, we exited at 2.90 for a small 7% profit.

The reason for this exit was the fast bounce off of our key level. These levels are key support/resistance levels, and how the market moves around the target levels determines how we trade. If the market is bouncing quickly off a key level, we will normally move our stop to at least break even, if not tighter. Once again, knowing this key level and watching how the market responded at this level is what signaled us to exit the trade.

A good start to the month of April. Year to date we are up 4,453% in our SPX trading and 3,108% in our SPY trading. Which is consistent with our overall average of over 1,000% return per month. The key to our seeing this type of return is to trade consistent everyday, and use our SPX Daily Outlook. Of course the past is never guarantee of future performance, but we look forward to another exciting month of trading ahead of us.